The finance industry is evolving faster than ever before. With an onslaught of digital disruption, rapidly evolving regulations, intense competition, and even generational differences, professionals need much more than theory to thrive in the environment. An MBA in Finance Program is important, but what really moves the career needle are the MBA finance skills you build and employ in the real world. Today's employers seek candidates with strong technical skills, complemented by high levels of interpersonal skills and ethical sensitivity.

In this guide, we will break down the essential MBA finance skills for in-demand careers that matter in 2025 and beyond, look at what recruiters are interested in evaluating, and explain how to turn these capabilities into resume-ready evidence.

Why These Skills Matter Now

The finance industry is changing rapidly, powered by advances in AI, blockchain, ESG, and market transformations. Employers are shifting from theory to practice and differentiating between MBA graduates who have technical expertise, digital fluency, and the ability to think strategically.

The most important first step in building a career that differentiates itself in an increasingly competitive and technology-driven market is understanding the importance of MBA finance skills in today's world.

The Global Finance Environment is Changing

The global financial services market is growing faster than ever before, from 33.38 trillion in 2024 to a projected 35.86 trillion in 2025. This growth is a reflection of fundamental shifts in the environment. These shifts include artificial intelligence, blockchain, and digital assets, environmental, social, and governance (ESG) considerations, and changing consumer expectations. Legacy models of banking are shifting to new finance innovations, including decentralized finance (DeFi), robo-advisors, and digital payments.

For graduates, these shifts indicate that MBA finance skills must go beyond balance sheets. You need to be equipped with skill-based knowledge, digital fluency, and the ability to see the new risks clearly. Employers increasingly want candidates who can use financial analysis skills and integrate both legacy financial institutions and modern technologies to make capital allocation and investment decisions.

As these skills align with market demands, they directly influence career growth potential and earning opportunities, making them a key driver of competitive salary after an MBA in Finance outcomes.

Resumes vs. Reality: What Employers Are Actually Looking For

There is no question that academic credentials will always matter, but by 2025, the finance sector will be heavily focused on skills-based hiring. Recruiters will tell you that newly minted MBAs consistently lack the practical Excel, financial modeling, and analytic expertise they should possess. Employers want employees who can bring value on their first day on the job, and technical competencies in hand will trump academic pedigree every time.

When hiring managers are looking through applications, they see a lot of claims of “Financial Modeling.” What is more memorable are applicants who can actually show these resume skills that MBA finance hiring managers want with measurable outcomes, such as developing valuation models, coding in Python, or communicating complex analyses in imaginative yet digestible ways.

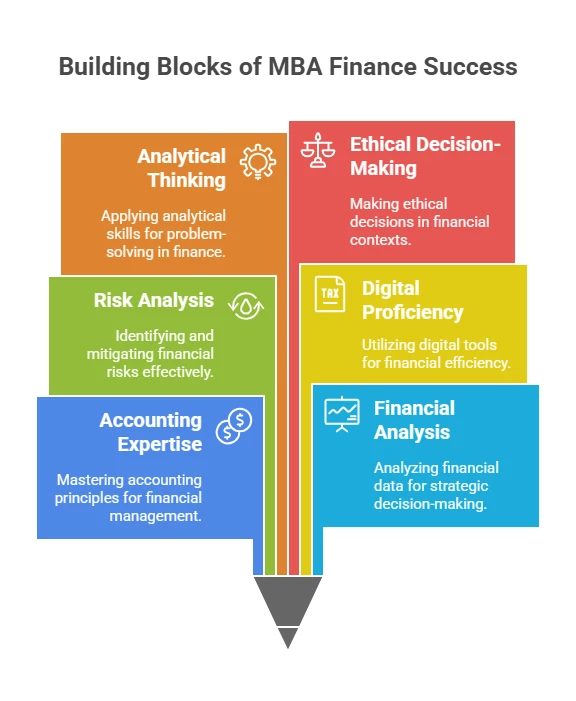

Core Technical Skills MBA Finance Grads Must Have

MBA finance graduates need a strong set of technical skills, particularly from core courses in accounting and finance, along with electives covering risk management and sustainable finance tools. When today's MBA finance graduates possess these technical capabilities, they can analyse and interpret data, predict outcomes, and align finance strategy with the overall business objectives. Technical skills were important in finance in the past, but in current finance careers, they are no longer optional.

Accounting skills

Accounting is the foundation of finance. MBA finance skills are related to accounting in interpreting balance sheets, income statements, and cash flow statements to make decisions. Skills extend to compliance, regulatory measures, and international accounting standards. Employers want grads who report the numbers they need, but more importantly, those numbers need to link to strategy.

Financial Analysis, Planning & Modeling

MBA graduates will find financial modeling to be one of the areas employers want the most from new hires. Basic financial modeling skills are advanced Excel skills, VBA functions, forecasting, etc. The coming and in vogue analysis languages used now are Python, SQL, and R. These techniques can analyze bigger datasets to test scenarios, model outcomes, and ultimately help to inform decisions related to capital investments.

Financial Reporting & Strategic Planning

Reporting is complex. Employers value professionals who can take complicated reporting and present it to leadership and investors as useful information and not useless noise. Valuable MBA finance skills in this area may be distilling executive dashboards, investor-ready presentations, or long-term and on-strategy financial forecasts.

Risk Analysis and Mitigation

Risk management has been complex due not only to whether some politically influenced market practices accelerate to global instability, but also to regulatory changes. Professionals in this space today need to stay current, conduct stress tests, Monte Carlo simulations, and test scenarios. Some core-risk MBA finance skills that would help in this area would be understanding the risks of credit, market, operational, and technology, but mostly the ability to effectively communicate conclusions to non-finance.

Digital Tools & Technological Proficiency

Digital proficiency is now table stakes. Graduates will need to be conversant in ERP systems, different financial software programs, and data visualization tools like Tableau or Power BI—beyond just Excel. If you also have exposure to blockchain, AI-driven analytics, and fintech platforms, you will be competitive in the job market. These technical and soft skills that are in demand in MBA Finance personnel are what differentiate potential future leaders from the pack.

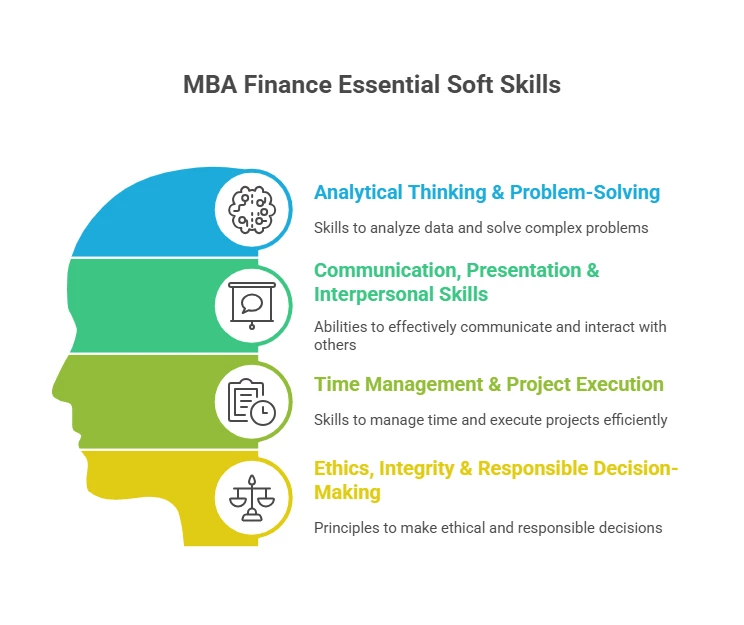

Essential Soft Skills for an MBA Finance Career

Employers are also looking for MBA graduates with soft skills in finance, including interpersonal skills like analytical skills, communication skills, time management skills, and developing an ethical framework for decision-making. These social skills improve an MBA Finance career opportunities, in addition to developing an ability to lead a team, analyse insights using data, and make responsible decisions in the pressure-cooking situation typical of the finance industry.

Analytical Thinking & Problem-solving

Analytical thinking lies at the core of the work done across finance. Employers want graduates who can break apart complex problems, develop trade-offs, and create nimble solutions. That is one of the most desired skills employers desire in MBA graduates for finance positions.

Communication, Presentation & Interpersonal skills

Finance professionals need to tell a story with numbers. MBA graduates will need the skills to break down technical concepts into simple terms, to prepare and deliver persuasive presentations, and to actively build relationships with individuals across teams. Strong communication ensures that the insights you share will have an impact on strategy - this is critical for leadership positions and for any career after an MBA in finance.

Time Management & Project Execution

Explicit and implicit timelines drive the world of finance. Employers look for professionals who can prioritize multiple priorities, allocate resources effectively, and deliver high-quality results. Strong project execution and time management skills will often be the difference between getting promoted and chronically staying stagnant in one's position.

Ethics, Integrity & Responsible decision-making

Ethics and integrity are not optional, given the increased scrutiny on regulations. There are certain technical and soft skills the MBA finance graduate must be able to demonstrate, including ethical decision-making, transparent judgment, and responsible decision-making. Employers favour candidates who uphold governance criteria while still achieving results.

Resume-Ready MBA Finance Skills Spotlight

When developing your CV, emphasize the resume skills MBA finance recruiters will look for, including:

- Technical Skills: Financial Modelling, Data Analytics, Risk Modelling, Advanced Excel, and Python.

- Soft Skills: Decision-making, Leadership, Spoken word, and Teamwork.

Quantify your achievements rather than listing your duties:

- "I developed a financial model that resulted in a $50 million investment decision."

- "I led a cross-functional team to complete a strategic planning project two weeks earlier than expected."

Also note that if you have a certification, CFA, FRM, PMP, or AI/blockchain finance credentials, you will certainly enhance your profile.

Building and Demonstrating MBA Finance Skills

To build these important MBA finance skills for careers, you will have to take what you learn in the classroom and apply it in a hands-on environment. Here is how;

- Do internships in corporate finance, investment banking, or Fintech.

- Go to finance case competitions to practice modelling as well as strategy.

- Get certifications that will validate your technical edge.

- Be aware of industry publications, Fintech innovations, and regulatory changes.

When you review MBA programs, compare MBA course fees, faculty credentials, and placement opportunities. Be sure to examine the MBA admission requirements early so you can organize accordingly. When you graduate, there will be many careers you can pursue after an MBA in finance, from consulting to investment banking. Although salaries after an MBA in finance can be lucrative, the real benefit is the prospects for personal leadership potential and professional development.

If you are not certain which path to pursue, weigh MBA Finance vs MBA Marketing. Finance is more suited for individuals who enjoy data, risk, and analysis. Marketing is suited for individuals who enjoy creativity and understanding consumer psychology.

Conclusion

There is a transformation happening in finance, and employers are also transforming. To stand out as an MBA finance graduate requires a blending of strong technical skills in areas like accounting, modelling, and risk management, with important soft skills like communication, ethics, and delivery of project commitment.

As we look toward 2025, employers will continue to move to the next step of the candidate evolution by asking graduating cohorts to provide the demonstrated ability to leverage technology, think strategically, and deliver value to their organization from day one.

By actively developing and showcasing this skill set, MBA graduates can unlock high-impact roles, achieve career mobility, and thrive in today’s competitive finance market.

.png)

.png)