| Bank of Baroda LBO basic salary Per Month in 2025 for beginners is Rs. 48,480 per month. The gross monthly salary comes around Rs.80,000 (approx.). In-hand salary after standard deductions is between Rs.70.000 and Rs.75,000. Check detailed breakdown of allowances. |

Bank of Baroda recruitment is going for 2025. There is a vacancy of around 2500 posts for local bank officers. The deadline to apply has been extended to 3rd August 2025.

Bank of Baroda LBO basic salary Per Month in 2025 for beginners is Rs. 48,480 per month. The gross monthly salary comes around Rs.80,000 (approx.). In-hand salary after standard deductions is between Rs.70.000 and Rs.75,000(approx.)

Over time, with promotions and regular pay increases, the basic salary can reach Rs. 85,920 per month. In addition, selected applicants will receive allowances such as HRA and DA, as well as other benefits in accordance with bank regulations.

For those seeking the Local Bank Officer position at the Bank of Baroda in 2025, the compensation is quite competitive. Besides the starting base pay for an LBO in the Junior Management Grade Scale I (JMG/S–I) that is ₹48,480, extra benefits and allowances for the post make it a rewarding job. Those who are selected will also receive appealing additional benefits and chances promotions in their careers that result in salary growth with added allowances and benefits.

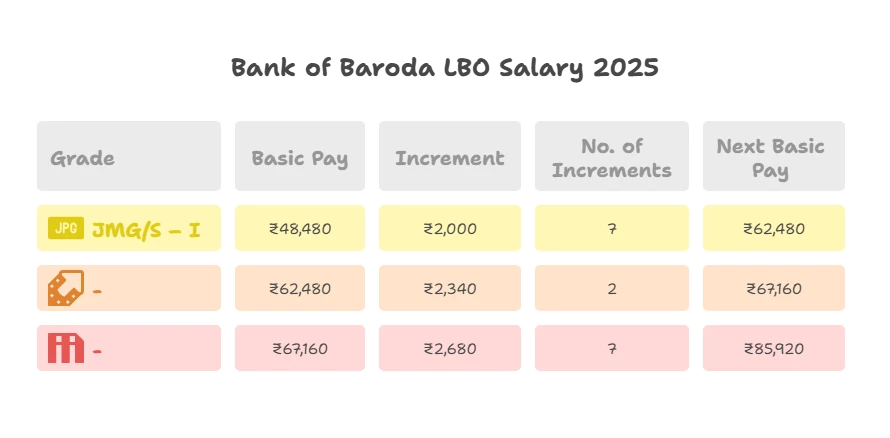

Those applicants who get selected shall compulsorily have to go for a probation period of 12 months that is 1 year from the date they join. During this time, the candidate's performance is analyzed and evaluated to ascertain suitability and contribution for the role. The grade, basic pay, increments, and the next basic pay after increments is presented below:

Note: Selected candidates with at least one year of experience as an Officer in a Scheduled Commercial Bank or a Regional Rural Bank (as listed in the Second Schedule of the Reserve Bank of India) will receive one advance increment. Prior experience will not count toward service seniority.

Important for staying updated: Upcoming Bank Exams in India 2025 - Eligibility, Preparation Tips, and Recruitment Dates

The following is an analysis of salary growth for Bank of Baroda LBO as extrapolated from the table presented above:

Pay Increases That Are Planned and Regular:

Starting at ₹48,480, your pay will rise by ₹2,000 each year for the first seven years, up to ₹62,480. This gives you a dependable and regular increase in pay early on. It helps you plan your finances and pushes new hires to remain dedicated during their first few years.

Slower Growth in the Middle of Your Career

After the initial seven raises, the following two raises are ₹2,340 each, followed by seven raises of ₹2,680. This system rewards those who stay, but the reduced number of raises in the middle years (only two years) might feel like a slow patch in pay increases. The actual growth picks up again only toward the end. This could make mid-career employees unhappy, as they might want steady or faster growth.

Focus on Keeping Employees Long-Term

The way the raises gradually get bigger (₹2,000 → ₹2,340 → ₹2,680) shows a focus on keeping employees for a long time. Employees who stay on will notice a large rise by the 16th year, with a final base pay of ₹85,920. But the long time it takes to get to this point may not attract younger workers who are looking for quicker financial rewards or promotions, especially in a banking or government setting where competition is high.

Check: Bihar State Cooperative Bank Clerk Salary

Compare Bank of Baroda LBO Salary with SBI Bank PO Salary

Bank of Baroda LBO Benefits, Perks and Allowances 2025

In 2025, Bank of Baroda provides a full benefits package for its entry-level officers.

- Key allowances include a Dearness Allowance (DA), which changes every three months based on the CPI and usually makes up about 40–45% of the base salary.

- There's also a House Rent Allowance (HRA), which is 7% to 9% of the base salary depending on the city. Some cities also offer a City Compensatory Allowance (CCA). Employees also get a Travel Allowance, money back for newspaper costs, a cleaning allowance, and travel money, but these amounts change based on location and job.

- Besides the money, BOB has health insurance for employees and their families, leave travel benefits, and pension plans under the National Pension System (NPS).

- Officers may also get housing or money for rent, yearly bonuses based on performance, advances for festivals, and can use staff welfare funds.

- Other benefits are staff loans with low interest, career training, and life and accident insurance. All of these benefits help ensure that BOB employees have financial security, a good work-life balance, and lasting stability in 2025.

Do a detailed comparison with SBI Bank Manager Salary 2025, Average Salary, Growth Possibility and Additional Pay

| Important Note: The above allowances mentioned in percentages may vary depending upon multiple factors as mentioned. For accurate details, please refer to BOB notifications for exact values. |

Know more: PO Full Form and Bank Manager Salary

Bank of Baroda Local Bank Officer's Salary Slip

In 2025, a Bank of Baroda Local Bank Officer's (LBO) pay stub usually shows the salary setup for officers at the Junior Management Grade Scale-I (JMG/S-I) level. Depending on the city type (rural, semi-urban, or urban), the total monthly pay is around ₹80,000. The pay stub lists Basic Pay (starting at ₹48,480), Dearness Allowance (DA) based on inflation, House Rent Allowance (HRA)( depending on where you are), Special Allowance, Learning Allowance, City Compensatory Allowance, and other approved benefits.

The pay stub also shows deductions for Provident Fund (PF), Professional Tax, Income Tax (TDS), and NPS (National Pension Scheme) contributions. After these deductions, a Local Bank Officer's take-home pay is about Rs.70.000 and Rs.75,000(approx.) The pay stub indicates yearly increases based on the salary scale and performance. It also includes bank benefits like leased housing (instead of HRA), reimbursements, and leave encashments.

Read: How to Become a Bank Manager in 2025.

Check more: How to Become an Investment Banker in India, Investment Banker Salary in India

Bank of Baroda's LBO Postings

Bank of Baroda's LBO postings are usually all over India. This means that if you are chosen, you could be sent anywhere in the country, depending on what the bank needs. The bank makes the final call, though they might consider your language skills or where you were hired.

Officers may end up in cities, smaller towns, or rural branches, mostly where they are growing the business, handling library resources, or opening new branches. You might get moved around regularly based on how well you are doing, bank rules, or what the administration requires.

Service Bond for Bank of Baroda LBO

If you get the LBO job, you will probably have to sign a service bond. The bond's cost and length might change a bit each year, but it is usually about 3 years. If you leave before the 3 years are up, you will likely have to pay a penalty of about pay ₹ 5,00,000 + applicable taxes if leaving early. The bank does this to make sure they get back the money they spent training and hiring you.

Work Responsibilities of Bank of Baroda's LBO

The Loan Banking Officer (LBO) mainly deals with loan services for individual and small to medium-sized business clients.

- They process, check, and approve loan requests.

- LBOs judge if a borrower is creditworthy by looking at financial records and running background checks.

- They make certain loan payouts adhere to RBI and bank rules.

- These officers work with clients to explain loan conditions, payment plans, and paperwork.

- They are a big part of collecting payments and managing bad loans.

- LBOs also sell related products like insurance or credit cards when needed.

- They watch loan accounts and do regular audits as part of their job.

- They make reports for superiors and assist in risk evaluation.

- Good communication, record-keeping, and analysis skills are very important in this position.

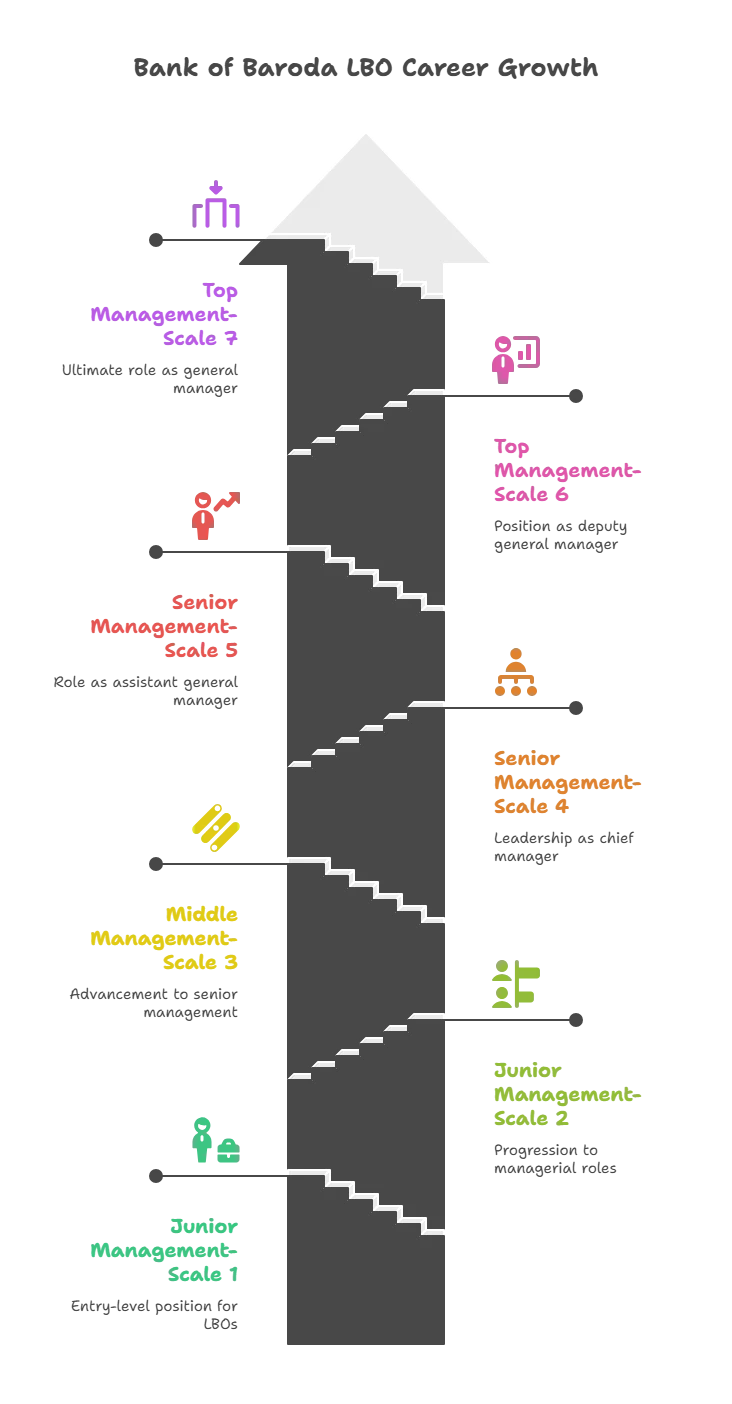

Bank of Baroda Local Bank Officer Promotions

The promotions are structures and channelized. It depends upon candidate's performance, evaluation and overall contribution. The promotion ladder is presented below:

Skills Required to Excel as a Bank of Baroda Local Bank Officer

A Bank of Baroda (BOB) Local Bank Officer should know financial products, the local market, and how to handle customer relationships. They must be good at using banking software and understand banking operations and rules.

- Since these officers often work with customers in rural areas, they need to communicate well in the local language.

- It's important to explain financial products clearly, like savings accounts, loans, insurance, and online banking.

- Basic math skills, the ability to analyze data, and knowledge of government programs also help.

- Also, being patient, understanding, and able to negotiate and build trust are key.

- A Local Bank Officer should find customer needs, collect paperwork, fix problems, and support financial inclusion.

- They often do fieldwork and engage with the community, so being comfortable speaking in public, organizing events, and having a good relationship with local leaders helps them do their job well and build trust in the bank.